We are probable witnessing the last stage of a major bull market in US stocks. However, knowing if this stage will take a few weeks or a few months is what matters and that information is not yet evident to us. On the other hand, there has been a pickup in economic indicators that sent the 10-year Treasury note’s yield on Friday to a nine-month high of 4.986% (from 4.857% a week earlier). Barrons this weekend mentions that China’s central bank may be shifting some of its enormous Treasury holdings from notes to bills. The other explanation, that the market is betting on a second quarter rebound of US GDP, we tackle first under our usual report format below.

THE MATRIX

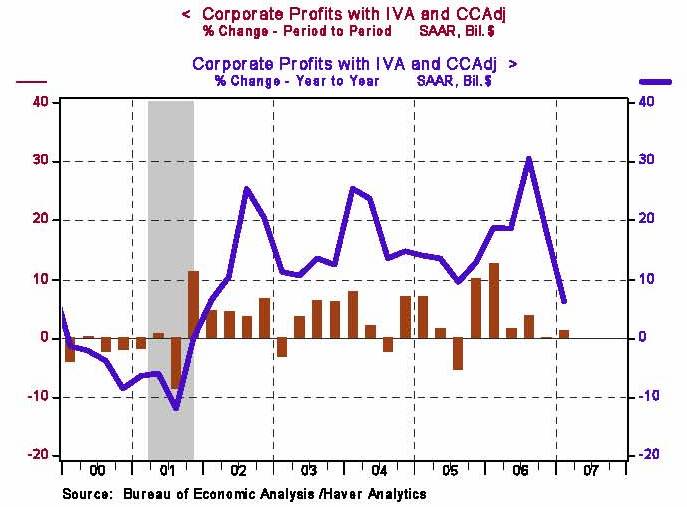

Real GDP grew only 0.6% in the first quarter, but the consensus is that capital spending will bring 3% growth back, partly on expectations that corporate profits will lift capital spending. However, corporate profits, (up 6.4% in the first quarter) are sharply trending down after five quarters of double-digit growth (see first chart below). On the other hand, consumer demand has been decelerating since the third quarter of 2006 (see next chart), so neither trend supports the pickup in capital spending argument.

With respect to the May jobs number (157k up), it is being questioned not just by perma-bear economists like Roubini, Ritholtz or Kasriel, but by everyone who cared to look deeper, as shown by Justin Lahart´s excellent analysis attached below. Finally, with respect to the strong pick up in manufacturing this quarter, it is obvious this is not in response to new demand from consumers but a natural consequence of companies throttling back production after wiping out 2006´s inventories in the first quarter. As consumer spending may be about to slow significantly (as real estate and credit-card credit taps out), manufacturers may have second thoughts, but for now, stock investors can enjoy the ride, probably until July, when everyone may realize that 3% growth level is not coming back in the second half.

LOCALY GROWN

As shown by Mayela Armas´report below, during the first quarter of this year, we spent $1.2 billion more than we earned during each month. We covered that deficit by issuing new debt and by using up our reserve savings. To be sure, we are not overspending on investment; we are merely financing our monthly public payroll. This partly explains why our reserves are starting to decrease so rapidly, the rest hast to do with the new arrangement whereby the Central Bank never gets to see PDVSA´s dollars before they get spent by the Treasury (also noted in Mayela´s article). In another key economic analysis, Victor Salmeron shows how, not even by boosting imports ($9.1 billion during the first quarter) to a 10-year high have we been able to stop inflation (30.2% in food prices). It looks like if we were able to reach the $40 billion import figure for 2007 (projected from the first quarter), it would have to come from consuming every cent from our liquid Central Bank reserves (some $18 billion –since about $7 billion are gold) and everything we get from PDVSA this year. Yet, even then, our inflation numbers will keep growing together with the incredible growth of our monetary base (60% over the pats 12 months). As pointed out in Salmeron´s article it doesn’t look like our economy is sustainable unless oil prices rocket up miraculously, but soon, because otherwise, it might come to be like the man says: “All this aggravation ain’t satisfactioning me”

PARALLEL UNIVERSE

In our opinion, there are three main factors behind future parallel rates, one is positive and the other two are negative:

Positive

From the minister’s announcement last week, Venezuela is about to issue $500 million in external bonds (Bolivian), together with $500 million in TICC before month’s end. He also announced that at some point during the second quarter, then country will issue another Bono-Sur package with at least $750 million in external bonds (Argentinean and Ecuadorian) plus $750 million in TICC.

Negative

The Central Bank´s Monetary Base stands at Bs. 116.899.747 million (see http://www.bcv.org.ve/cuadros/1/121.asp?id=47), which added to Central Bank CD´s outstanding of Bs. 48.950.964,00 (see http://www.bcv.org.ve/excel/1_3_30.xls?id=132), comprises a total of Bs. 165.850.711 million that can be converted into foreign currency. Simultaneously, Central bank reserves stand at $25.156 million (see http://www.bcv.org.ve/cuadros/2/211.asp?id=28), to which we cannot add FONDEN balances, because they are spent or in the process of being spent and thus cannot sustain currency conversion. Finally, if we divide Bs. 165.850.711 million into $25.156 million, we obtained that the currency’s Implicit FX rate amounts today to Bs. 6.603/$.

Negative

As pointed out above, US real consumer spending would at the heart of the coming recessionary process and if it gets confirmed over the next few weeks or months, it will trigger a stock market sell-off as both always precede recessions. A bursting stock market will bring down with it the prices of all commodities, including oil. If oil falls, the fragile state of our LOCALY GROWN economics, as pointed out above would begin a serious downward cycle.

Leave a Reply