Links

-

BITCOIN’S POWER LAW THEORY

WHY POWER LAWS PREDICT THE RISE OF BITCOIN OVER FIAT One of the best-known instances of power law dynamics occurs in regards to how mammals can be characterized as scaled up versions of each other, according to power laws that roughly determine their size. Thus, if you know the size of a mammal species, you…

-

BITCOIN INSIGHTS, IDEAS AND THEORIES

I am thrilled to introduce a new blog series on Sequoian.com that delves into some of the most compelling insights, ideas, and physical principles that have spawned around Bitcoin since inception in 2009. In ” Exploring Bitcoin Insights, Ideas and Theories,” we will embark on a journey through the fascinating concepts that shape our understanding…

-

BITCOIN’S GAME THEORETICAL DYNAMICS CHARTED!

Oswaldo Lairet February 26, 2023 What the NYFED describes in The Bitcoin–Macro Disconnect as “Bitcoin’s price puzzling disconnect to monetary news” is coincidentally the pattern I came across in December 2022, while methodically tracing all 14 years of the BTC/USD price curve. Though they don’t express it as clearly, what Messrs. Benigno and Rosa describe…

-

THE GREAT PREDATOR-PREY CYCLE RESET

Since Greenspan’s 1987 FED appointment, G7 central banks began signaling an interest rate policy that visibly favored using debt, instead of cash, to promote economic growth. A monetary policy that “achieved” a trinity of incompatible goals: 1. Persistently low prices & wage inflation at the suitable expense of 2. Promoting asset-price inflation, which in turn,…

-

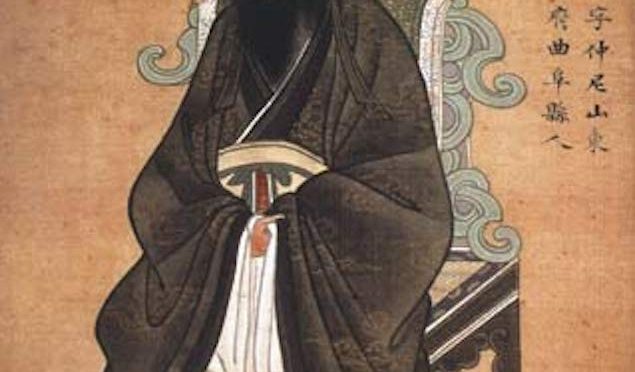

FROM MONETARY SERFDOM TO DECENTRALIZED TRUST

Writing and Illustration, Oswaldo Lairet “Just as individual control of fire changed the balance of power between humans and nature, individual control of the energy to monetize, store, access, transfer, and protect, value-creation, has shifted the power balance between ordinary humans and nations.” ―The Bitcoin Power Shift SUMMARY Over the past two millennia, Seigniorage, as…

-

MORAL HAZARD, THE HIDDEN ALCHEMY BEHIND FIAT MONETARY DISTORTION

As the largest monetary expansion in history fails to contain the long-term debt cycle that ended in 2008 (see The 40-Year Market Distortion Unwind), while spurring unprecedented levels of moral hazard, the barely-hidden financial crisis stands as proof that Predator-Prey Resource Competition Dynamics governs mankind as it does all living things — regardless of the…

-

UNLEARN FAKE ECONOMICS TO LEARN BITCOIN

The Pied Piper Finally Meets His Match!

-

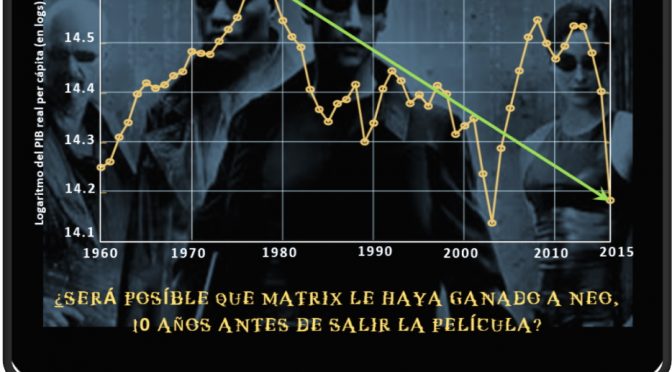

“¡NO ES LA ECONOMÍA, ESTÚPIDO!” ES LA PROCEDENCIA DE LOS FONDOS

ANTECEDENTES = PROCEDENTES Repeler al capital de origen criminal es más urgente que cualquier otro objetivo de la agenda económica -La data histórica lo comprueba tanto en PPP como en Bs. GRÁFICAS . Al contrario del capital que depende de enriquecer a la sociedad maximizando su retorno, la viabilidad del capital criminal sólo depende de corromperla.

-

HOW I LEARNED TO STOP WORRYING AND LOVE BITCOIN!

“Gentlemen, you can’t fight in here” … After Bitcoin Replaces Fiat! Bitcoin is the first example of a new form of life.It lives and breathes on the internet.It lives because it can pay people to keep it alive.It lives because it performs a useful service that people will pay it to perform.It lives because anyone,…

-

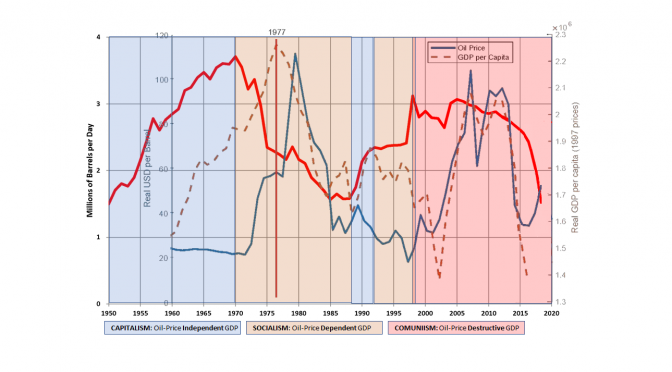

VENEZUELA IN ONE CHART

“Capitalism is the only system of economics compatible with human dignity, prosperity, and liberty. To the extent we move away from that system, we empower the worst people in society to manage what they do not understand.” — Frederick Hayek Venezuela epitomizes Hayek’s dictum. It enjoyed the world’s fourth highest per-capita income in 1961, when it…

-

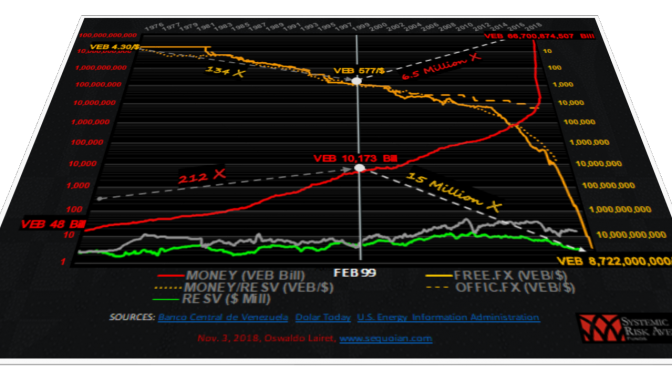

SPINNING HYPERINFLATION AT 6.5 MILLION TURNS

SPINNING HYPERINFLATION AT 6.5 MILLION TURNS Only one year after measuring how much devaluation the Chavista regime had imposed on its citizens since 1999, the aggregate sum of counterfeit money the Venezuelan central bank has issued totals 6.5 million times the amount of Bolivars available in Venezuela, when Chávez came to power in February 1999.…

-

MERITOCRACY, THE MAGIC BEHIND CAPITALISM

MERITOCRACY, THE MAGIC BEHIND CAPITALISM