Category: Case Study

-

WHY THE US DOLLAR WILL KEEP GETTING STRONGER

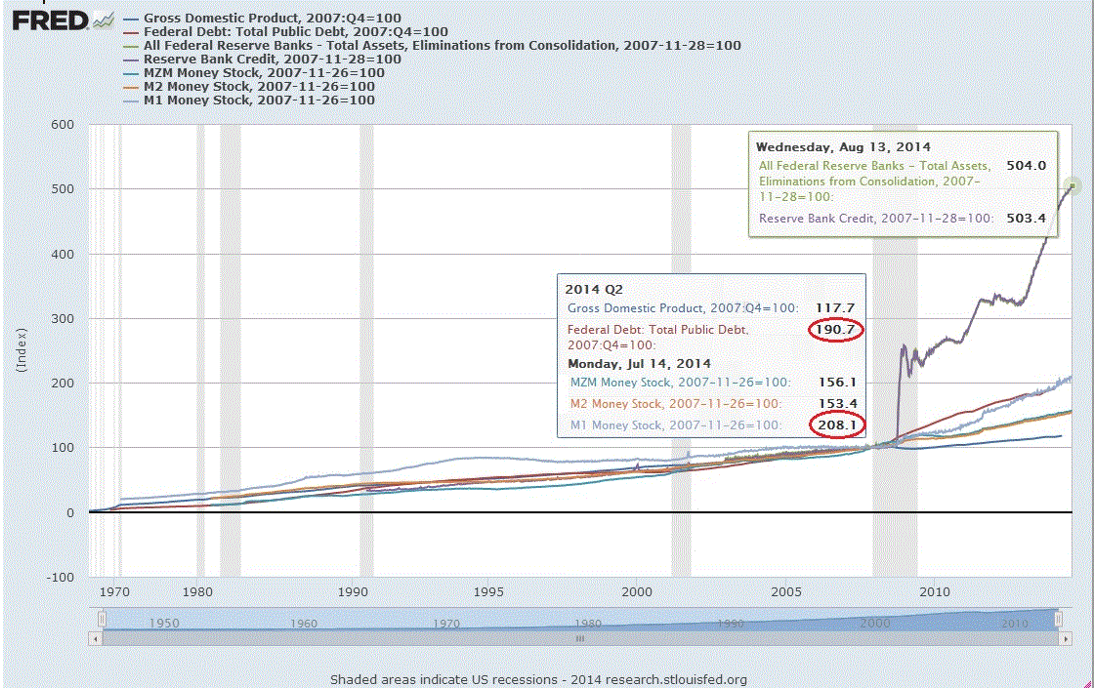

Regardless of experiencing a 25% GDP Decay since 2007 (Table 1, Page 3 &updated graph, above), the USD has appreciated by 15% since 2011 (DTWEXM), as the US decreased its oil imports by 60%. Recently, the US became once again, the world’s largest oil producer, while oil imports have dropped from a 2006 high of…

-

MITIGATING LEGALLY MANIPULATED FINANCIAL MARKETS AND STATISTICS

INFORMATION ASYMMETRY BY DESIGN

-

QE IS EXACTLY WHY THE SKY IS FALLING!

07-05-2013Oswaldo Lairet – Sequoian Financial Group Research Summary: Since our start in 2005, we have sought to keep reports entertaining, even while including the charts, links, mathematical proofs or documentation supporting our opinions. Like our 2006 and 2007 reports, this one is meant to warn you in advance of potential market trouble. This time, however, we set up a…

-

CENTRAL BANK RESERVES

This month, investors absorbed some important news announcements, among them: the nationalization of the last four oil fields, a 35% drop in Central Bank Reserves, the IMF-withdrawal statement and the threat to nationalize the banking industry. Below we will try to figuratively deconstruct what these messages may mean for all “three” sides of the fence.…

-

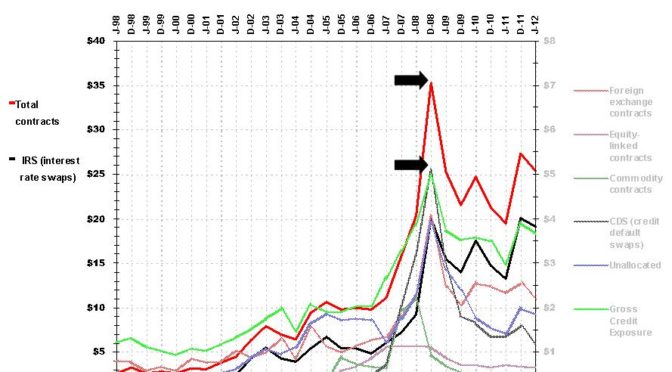

COLLATERALIZED DEBT OBLIGATIONS

Collateralized Debt Obligations, or CDOs for short can be created from many types of collateral, but the most popular lately are CDOs from MBS (Mortgage Backed Securities). The idea is to create some higher risk assets and some much safer ones, slicing up the MBS into what are called equity, mezzanine and investment-grade bonds. The…

-

BLOOMBERG TELEVISION

Tuesday, when markets were down huge, Bloomberg Television inquired what we thought of the PDVSA bond plunge of the past few weeks. We pointed out that PDVSA bonds had done nothing but follow the rest of Venezuela’s external debt bonds down in price. If you look at the first graph below, you will notice that…

-

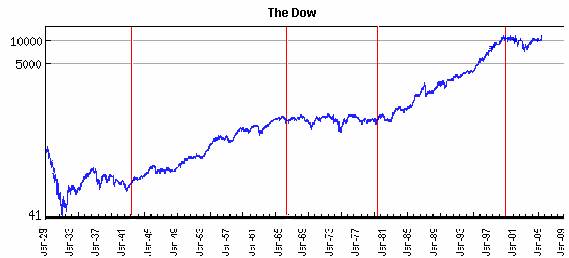

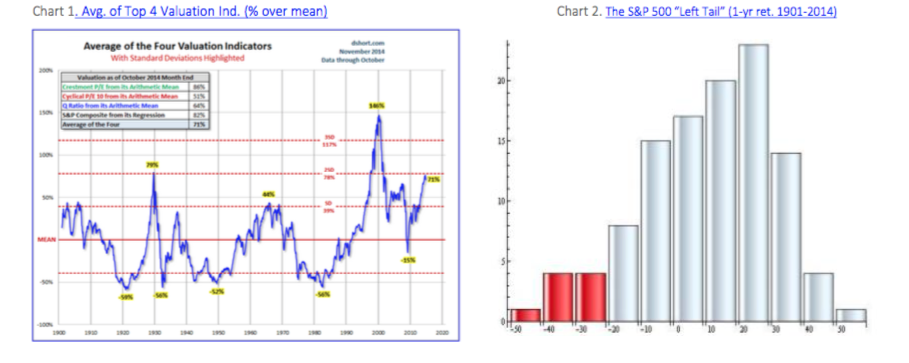

US stocks

We are probable witnessing the last stage of a major bull market in US stocks. However, knowing if this stage will take a few weeks or a few months is what matters and that information is not yet evident to us. On the other hand, there has been a pickup in economic indicators that sent…

-

THE MATRIX

Given the busy circumstances posed by the last two bond issues from the government, we haven’t been able to present our economic reports as often as usual. In order to correct this, going forward, we will publish a short weekly or biweekly report with a minimum of three sections initially: THE MATRIX, analyzing the US…

-

THE MATRIX II

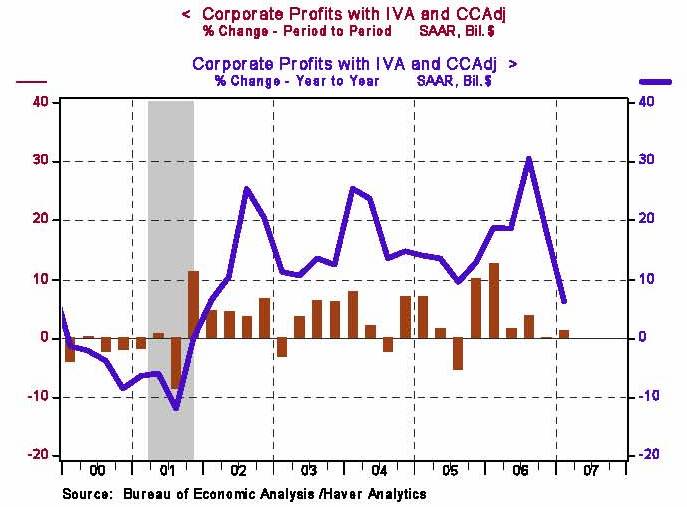

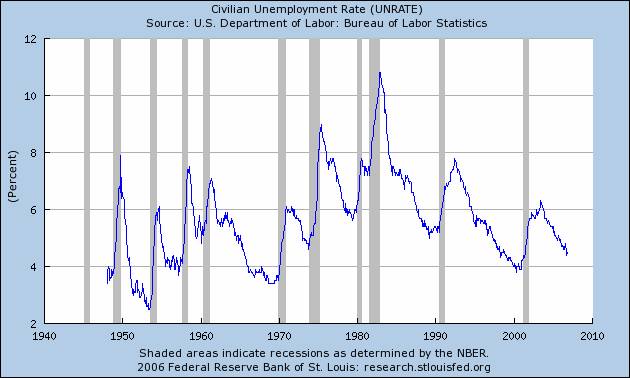

THE MATRIX The 88,000 jobs added in April is the smallest increase since November 2004 and a factor in lowering year-to-date average monthly increase in jobs to 129,000 versus 2006´s 189,000. This untimely trend comes at a time when falling home prices prevent US households from cashing any more home equity via mortgage debt or…

-

PORTAFOLIO VITAL

Some of our PORTAFOLIO VITAL* clients have asked us why we keep invested in dollars (10-year US Treasuries at a 4.64% yield) in preparation for the coming US recession. Even as we explain in detail that log-term US treasuries generally escalate in price when recessions take hold, these customers wonder why we won’t take cover…

-

THE WIZARD & THE DEMENTORS

THE WIZARD Ben Shalom Bernanke is probably one of the smartest people on earth. A summa cum laude from Harvard, PhD from MIT and ex-full time professorship form Stanford, prepared him well to sort out the economic mess inherited from another summa cum laude economist, Alan Greenspan. However, no matter how bright or knowledgeable he…

-

¿COMO PRESUPUESTAR PARA EL 2007?

-

CHRONICLES OF A “DEVAL” PREANNOUNCED

That’s the question many of our clients are asking since they need to decide whether to cover their FX exposure now or wait to see if the parallel rate drops further. Sadly, the answer is: Yes, 3500 is coming back. Not only for the seasonal reasons presented in last week’s report, but mainly because this…

-

“THIS TIME IS DIFFERENT”

Please do remind us strongly, if we ever utter those four words. This phrase is the curse of all wishful thinkers. It’s the ultimate hideaway used by optimists trying to sell you a story. They will always find an argument and an audience to discredit the past and “prove” why the historical norm doesn’t apply…

-

STRATEGY REGARDING CURRENCY EXPOSURE

Several readers have asked us for a strategy regarding their currency exposure. As always, rather than making predictions, we let the charts teach us their history lessons. If you visit http://www.cadivi.gov.ve/divisas/promedio.html, you will find CADIVI´s monthly summary of daily average dollar amounts “authorized” and “delivered” at the Official FX rate (2150) since January 2005. We…

-

COMBO-CHART BY THE ST. LOUIS FED

We developed the combo-chart below from data published by the St. Louis Fed (http://research.stlouisfed..org/fred2/). Both charts in the combination represent US economic history since 1962, including recessions (grey spouts). The bottom chart shows that since 1962, each US recession was preceded by the toppling of the 10-year treasury yield (blue line) by the 3-month treasury…

-

FX RATES IN 2007

In order to understand what may happen to FX rates in 2007, below, we attempt to abbreviate Venezuela’s last 30 years of monetary history through three graphs. Figure 1 points to the perpetual reality behind our economic performance: oil prices. In turn, Figure 2 shows how oil prices have affected Bolivar monetary mass (M3), and…

-

THE YIELD CURVE AND PREDICTING RECESSIONS

A paper titled “The Yield Curve and Predicting Recessions”, by Jonathan Wright, research economist at the Federal Reserve, describes the probability of an economic recession as a function of the spread between the yields on 10-year and 3-month U.S. Treasury securities (see http://www.federalreserve.gov/pubs/feds/2006/200607/200607abs.html). However, Wright and other researchers suggest that in addition to the spread…

-

WTI

As WTI rose over $72/barrell this morning on Norwegian strike fears and tightness in US gasoline summer supplies (see first article below), you may recall that our last analysis regarding oil carried a graph evidencing that while prices are reaching their historical high in nominal terms, oil suppliers seem unable to increase production. Our first…

-

TAKE YOUR PROTEIN PILLS AND PUT YOUR HELMET ON

“Take your protein pills and put your helmet on”. David Bowie Two weeks ago we pointed out that come next quarter; even if GDP starts crumbling, Bernanke will have to stay firm. The main reason being that at the first sign of easing, the US economy’s current pro-inflationary structure would entice a nasty dollar sell-off…

-

IN THE FACE OF HIGHER PRICES

As mentioned last week, this is our last bulletin. If you would like to receive future bulletins please follow the instructions at the end of this report. Today, we are revisiting two issues: Peak Oil and Bolivar FX Strategy. On the first subject, we found the one picture that says more than one thousand words.…

-

PROTECTING YOUR NEST EGG

In Part I of PROTECTING YOUR NEST EGG, we posted two articles that made exactly opposing arguments in front of the same economic outlook. Hopefully, you were able to pick “The Cheshire Cat” between the two. As proven by that day’s WSJ, you will encounter the same type of opposing arguments on major economic topics,…

-

STOCK INVESTMENTS HISTORICALLY (SPANISH)

To see post click this link to redirect you to a pdf Historical_Assessment_of_Stock_Investment

You must be logged in to post a comment.