Author: Oswaldo Lairet

-

BITCOIN’S POWER LAW THEORY

WHY POWER LAWS PREDICT THE RISE OF BITCOIN OVER FIAT One of the best-known instances of power law dynamics occurs in regards to how mammals can be characterized as scaled up versions of each other, according to power laws that roughly determine their size. Thus, if you know the size of a mammal species, you…

-

BITCOIN INSIGHTS, IDEAS AND THEORIES

I am thrilled to introduce a new blog series on Sequoian.com that delves into some of the most compelling insights, ideas, and physical principles that have spawned around Bitcoin since inception in 2009. In ” Exploring Bitcoin Insights, Ideas and Theories,” we will embark on a journey through the fascinating concepts that shape our understanding…

-

BITCOIN’S GAME THEORETICAL DYNAMICS CHARTED!

Oswaldo Lairet February 26, 2023 What the NYFED describes in The Bitcoin–Macro Disconnect as “Bitcoin’s price puzzling disconnect to monetary news” is coincidentally the pattern I came across in December 2022, while methodically tracing all 14 years of the BTC/USD price curve. Though they don’t express it as clearly, what Messrs. Benigno and Rosa describe…

-

THE GREAT PREDATOR-PREY CYCLE RESET

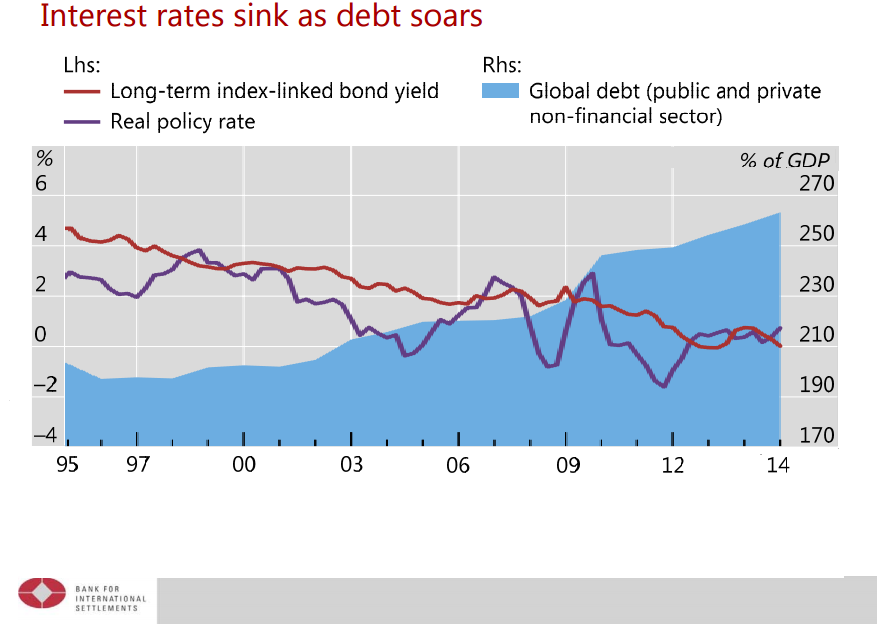

Since Greenspan’s 1987 FED appointment, G7 central banks began signaling an interest rate policy that visibly favored using debt, instead of cash, to promote economic growth. A monetary policy that “achieved” a trinity of incompatible goals: 1. Persistently low prices & wage inflation at the suitable expense of 2. Promoting asset-price inflation, which in turn,…

-

FROM MONETARY SERFDOM TO DECENTRALIZED TRUST

Writing and Illustration, Oswaldo Lairet “Just as individual control of fire changed the balance of power between humans and nature, individual control of the energy to monetize, store, access, transfer, and protect, value-creation, has shifted the power balance between ordinary humans and nations.” ―The Bitcoin Power Shift SUMMARY Over the past two millennia, Seigniorage, as…

-

MORAL HAZARD, THE HIDDEN ALCHEMY BEHIND FIAT MONETARY DISTORTION

As the largest monetary expansion in history fails to contain the long-term debt cycle that ended in 2008 (see The 40-Year Market Distortion Unwind), while spurring unprecedented levels of moral hazard, the barely-hidden financial crisis stands as proof that Predator-Prey Resource Competition Dynamics governs mankind as it does all living things — regardless of the…

-

UNLEARN FAKE ECONOMICS TO LEARN BITCOIN

The Pied Piper Finally Meets His Match!

-

THE BITCOIN POWER SHIFT

SLIDE 1 Just as individual control of fire changed the balance of power between humans and nature, individual control of the energy to monetize, store, access, transfer, and protect, value-creation, has shifted the power balance between ordinary humans and nations. Bitcoin’s Proof of Work turns energy into a generic entry-fee to preserve miner anonymity and…

-

“¡NO ES LA ECONOMÍA, ESTÚPIDO!” ES LA PROCEDENCIA DE LOS FONDOS

ANTECEDENTES = PROCEDENTES Repeler al capital de origen criminal es más urgente que cualquier otro objetivo de la agenda económica -La data histórica lo comprueba tanto en PPP como en Bs. GRÁFICAS . Al contrario del capital que depende de enriquecer a la sociedad maximizando su retorno, la viabilidad del capital criminal sólo depende de corromperla.

-

HOW I LEARNED TO STOP WORRYING AND LOVE BITCOIN!

“Gentlemen, you can’t fight in here” … After Bitcoin Replaces Fiat! Bitcoin is the first example of a new form of life.It lives and breathes on the internet.It lives because it can pay people to keep it alive.It lives because it performs a useful service that people will pay it to perform.It lives because anyone,…

-

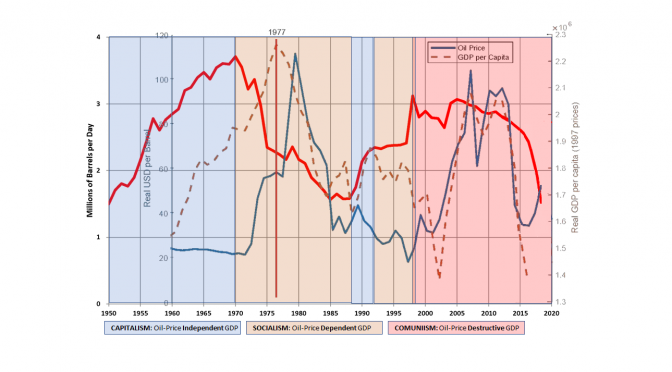

VENEZUELA IN ONE CHART

“Capitalism is the only system of economics compatible with human dignity, prosperity, and liberty. To the extent we move away from that system, we empower the worst people in society to manage what they do not understand.” — Frederick Hayek Venezuela epitomizes Hayek’s dictum. It enjoyed the world’s fourth highest per-capita income in 1961, when it…

-

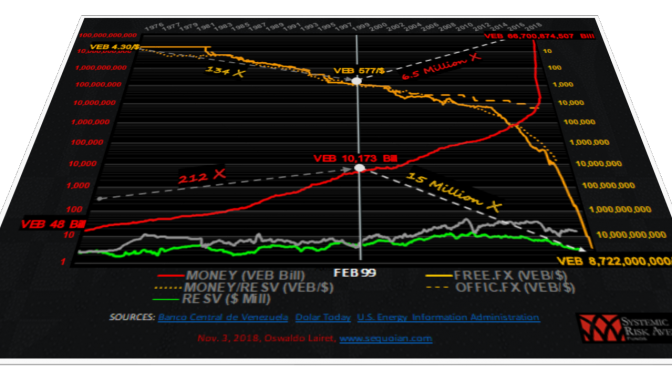

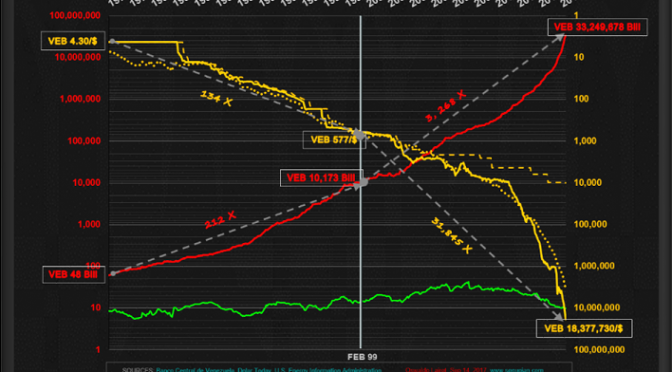

SPINNING HYPERINFLATION AT 6.5 MILLION TURNS

SPINNING HYPERINFLATION AT 6.5 MILLION TURNS Only one year after measuring how much devaluation the Chavista regime had imposed on its citizens since 1999, the aggregate sum of counterfeit money the Venezuelan central bank has issued totals 6.5 million times the amount of Bolivars available in Venezuela, when Chávez came to power in February 1999.…

-

MERITOCRACY, THE MAGIC BEHIND CAPITALISM

MERITOCRACY, THE MAGIC BEHIND CAPITALISM

-

SPINNING HYPERINFLATION AT 3.268 TURNS

SPINNING HYPERINFLATION AT 3.268 TURNS As a benchmark of Venezuela’s purchasing power for many decades, our “4.30” represents an ideal gauge to measure the degree of embezzlement gulped down by the current regime since 1999. In fact, the monetary dilution of the past 18 years has been so many times greater than “4.30,” we need…

-

HIPERINFLACIÓN A 3.268 REVOLUCIONES

HIPERINFLACIÓN A 3.268 REVOLUCIONES Como parámetro del poder adquisitivo que disfrutó Venezuela durante décadas, el “4,30”, representa un indicador ideal para medir el grado de malversación impulsado por el régimen actual desde 1999. De hecho, la dilución monetaria de los últimos 18 años ha sido tantas veces mayor al “4.30”, que necesitamos usar una escala…

-

PREDATOR-PREY ECONOMICS -SUMMARY RELOADED!

PREDATOR-PREY ECONOMICS -SUMMARY RELOADED! If Predator-Prey Economics formally existed as a field of study, it would address human economic interactions from the perspective of Resource Competition Dynamics. Predator-prey dynamics have been used since at least 1967 to model the growth cycle and more recently, Debt vs Capital, its most intuitive use considering that the former must feed on the latter…

-

BREXIT OR GLOBALEXIT?

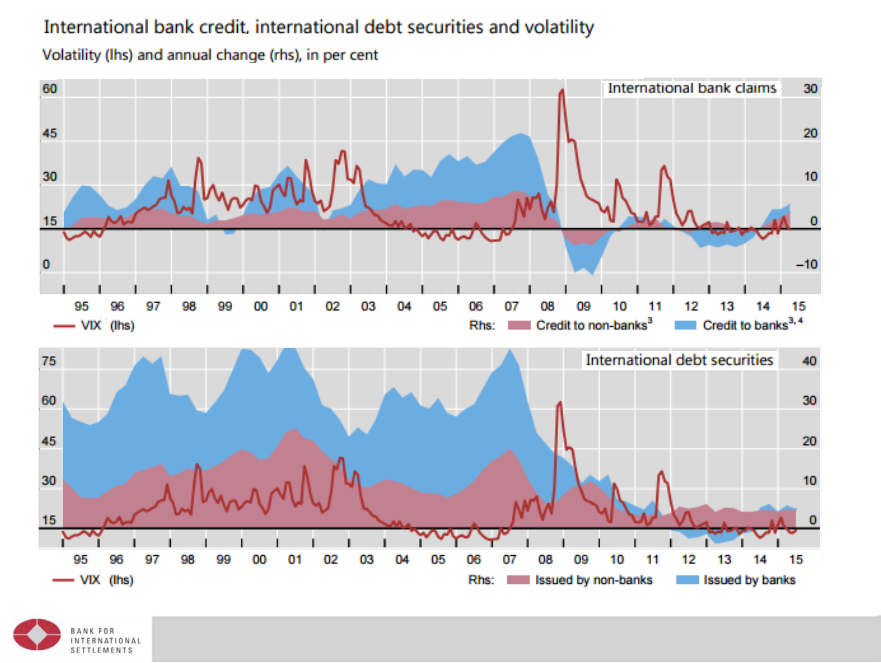

Typically, the Minsky Long Cycle ends with Trade retreating until it reaches global scale, while present-day “Trade War Warriors” such as Trump, Le Pen, Farage and other isolationists begin winning elections worldwide. Hence why, in my view, we’ll see the collapse of our current Globalization economic model over 2016 and 2017. Yet, as per the essay…

-

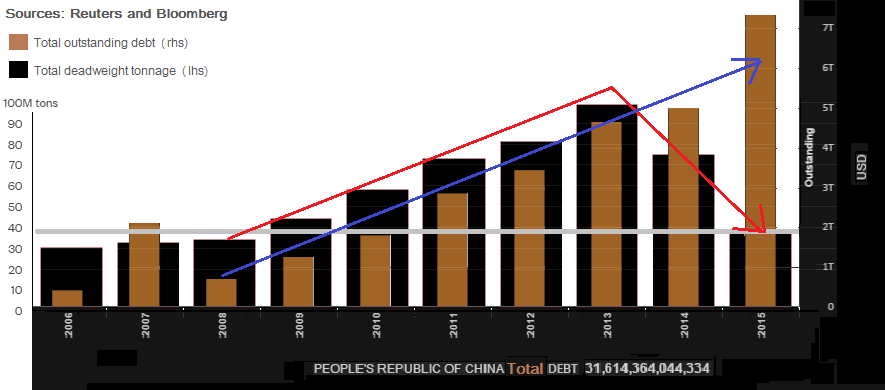

AND J.R.R. TOLKIEN SAID, “NEVER LAUGH AT LIVE DRAGONS”

As the Steel-Dragon flies over its 2009 high, it validates our premise that China’s colossal money printing is what truly underlies the world’s economic “recovery” since 2008. Just as it created $30 trillion of Yuan-denominated debt in 7 years, China may have injected upwards of $2 trillion over the past three months. Putting these numbers…

-

WAIT! IS IT 2016 OR 2008? QUICK, DIAL BACK THE DELOREAN!

While preparing a summary for a client, I went over presentations I gave, ahead of “The Great Recession.” Among them,I found a Veneconomia January 2008 Conference describing what could pass for January 2016. The material was so predictive then, you might as well check its contents…just, in case! The link again is Veneconomia January 2008…

-

BITCOIN > BLOCKCHAIN > INTERNET 2.0 > EQUAL INFO ACCESS

03-26-2016 BITCOIN > BLOCKCHAIN > INTERNET 2.0 > EQUAL INFO ACCESS Oswaldo Lairet – Sequoian Financial Group Research Time-decay makes this post more valuable as is (Spanish), but headings may help you choose what part to translate, if any! I. AMSTERDAM 1609 ALL OVER AGAIN! Nos aproximamos al punto en la historia, donde la élite politico-financiera mundial (el…

-

THE BIG-BANK THEORY OF MONEY AND NPV BLACK HOLES

STATIC ASSUMPTIONS CAN ONLY HAPHAZARDLY DESCRIBE THE DYNAMIC NATURE OF HUMAN ECONOMIC INTERACTIONS BETWEEN THE IRON GATES OF FATE, THE SEEDS OF TIME WERE SOWN -WITH SOUND OR “The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal…

-

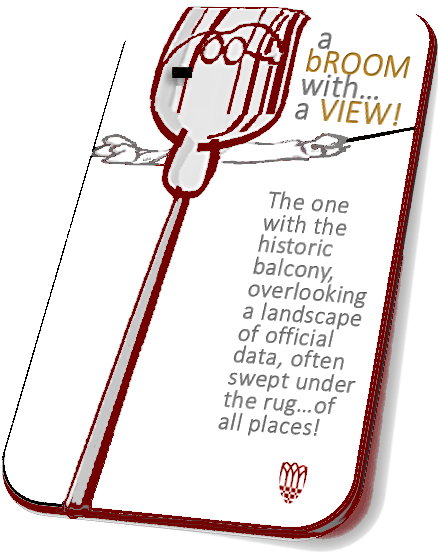

EVEN AS “TED” TALKS… A-WHOLE LOT OF SHAKING GOING ON

EVEN AS “TED” TALKS… A-WHOLE LOT OF SHAKING GOING ON

-

”CHINA’S PARTY ISN’T OVER” (WSJ)?

”CHINA’S PARTY ISN’T OVER” (WSJ)?

-

IT’S BEEN “GROUNDHOG DECADE” SINCE 1971

IT’S BEEN “GROUNDHOG DECADE” SINCE 1971

-

THE 2016 SOLUTION TO ZENO’S PARADOX

THE 2016 SOLUTION TO ZENO’S PARADOX

-

THE DISCOUNT-RATE PYRAMID SCHEME

THE DISCOUNT-RATE PYRAMID SCHEME

-

PREDATOR-PREY ECONOMICS

PREDATOR-PREY ECONOMICS As unlimited bailouts by central banks/governments make “unlimited predation” possible, the Predator (Debt) to Prey (GDP) Ratio escalates exponentially after each cycle oscillation. Then, as would be expected in unstable system dynamics, the patterns keep the system moving away from equilibrium after any initial shock until it eventually breaks.

-

HISTORY DOESN’T JUST RHYME, IT REPEATS!

Click HISTORY DOESN’T JUST RHYME, IT REPEATS!

-

MANAGING VOLATILITY AS AN ASSET CLASS: FIVE QUESTIONS

MANAGING VOLATILITY AS AN ASSET CLASS: FIVE QUESTIONS

-

THE FIXED-INCOME “MOTHER OF ALL BUBBLES ERA” DRAWS TO AN END

Click THE FIXED-INCOME “MOTHER OF ALL BUBBLES ERA” DRAWS TO AN END

You must be logged in to post a comment.